If you’re a frequent flier, maybe you’ve already been roughed up by an airline, rhetorically speaking. I try to stay away from planes myself. I fly very infrequently and I book airline tickets even less.

When I have a choice in domestic airlines, I prefer to fly on JetBlue or Southwest. They’re just my kind of carriers.

It’s a personal choice.

But this afternoon, as I was booking a seat from Orlando to Washington, and after getting through what seemed like a dozen irritating “upsell” screens, JetBlue showed me this:

JetBlue’s sneaky approach to selling travel insurance

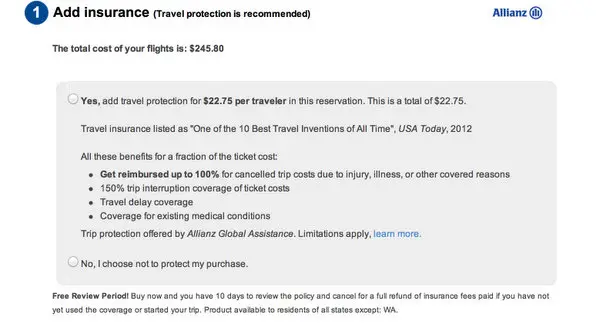

It’s an option to buy flight insurance from Allianz. Insurance is one of the most lucrative upsells, of course. And in case you weren’t paying attention, JetBlue is no slacker at collecting ancillary revenue from its passengers. It ranked fifth in reservation and change fees in 2012, collecting $133 million from its passengers; it came in ninth place for baggage fees during the same time, earning $70 million from its customers.

Then I focused on the button at the bottom of the box. Let’s zoom in.

Say what? I choose “not to protect my purchase”?

I would have expected JetBlue to say, “No, I decline the optional travel insurance.”

But “choose not to protect” almost implies you’re opting out of seatbelts. I feel like I’m telling the mobster, “Nah, I don’t need any protection.”

If I choose not to “protect” my flight, what could go wrong? I must not be the only person who is left to wonder.

Making matters worse, JetBlue insisted I make a choice. It wouldn’t process my reservation unless I checked “yes” or “no.”

Come on.

I’m a believer in the value of travel insurance, (here’s our guide to travel insurance.) and I know the folks at Allianz personally. But I’m not convinced that buying flight insurance as an “oh-by-the-way” purchase is ever a good idea. If you’re going to take the insurance, you need to shop around and study the policy to make sure you’re covered.

This is not the way to do it, using scare tactics and not giving the customer any time. Because hey, those airfares are known to expire.

I’m disappointed in JetBlue. It might as well pre-check the “accept” button “for my convenience.”